Goldman Sachs Group (GS)

904.55

+0.00 (0.00%)

NYSE · Last Trade: Feb 13th, 8:37 AM EST

Detailed Quote

| Previous Close | 904.55 |

|---|---|

| Open | - |

| Bid | 902.66 |

| Ask | 905.46 |

| Day's Range | N/A - N/A |

| 52 Week Range | 439.38 - 984.70 |

| Volume | 9,352 |

| Market Cap | 310.66B |

| PE Ratio (TTM) | 18.39 |

| EPS (TTM) | 49.2 |

| Dividend & Yield | 16.00 (1.77%) |

| 1 Month Average Volume | 2,636,879 |

Chart

About Goldman Sachs Group (GS)

Goldman Sachs Group is a leading global investment banking, securities, and investment management firm that provides a wide range of financial services to a diverse client base, including corporations, financial institutions, governments, and individuals. The company engages in various activities, including financial advisory services, underwriting of capital market transactions, asset management, and market making in securities and commodities. It is known for its expertise in mergers and acquisitions, risk management, and investment strategy, leveraging its extensive research capabilities and global reach to deliver innovative solutions in an ever-evolving financial landscape. Read More

News & Press Releases

Wall Street expects another good year for the S&P 500 despite economic uncertainty created by President Trump's tariffs.

Via The Motley Fool · February 13, 2026

Shares in this computer memory specialist have soared over the last few months. But what comes next?

Via The Motley Fool · February 12, 2026

The U.S. labor market is facing a moment of profound reckoning as new data reveals that the economic engine of 2025 was far more sluggish than previously reported. On February 6, 2026, the Bureau of Labor Statistics (BLS) released its annual benchmark revisions, striking a devastating blow to the

Via MarketMinute · February 12, 2026

Bank of America (NYSE:BAC) has released its highly anticipated 2026 M&A Outlook, signaling a transformative shift in the global deal-making landscape. After years of cautious maneuvering and high interest rates, the bank’s Global Corporate & Investment Banking (GCIB) division characterizes 2026 as a "Powering Up" year. The report

Via MarketMinute · February 12, 2026

Following the release of a robust January jobs report that exceeded all Wall Street expectations, President Donald Trump has reignited his aggressive campaign against current Federal Reserve policy, calling for the United States to implement the “lowest interest rates in the world.” The President’s remarks, punctuated by a celebratory

Via MarketMinute · February 12, 2026

The financial world experienced a seismic shift on January 30, 2026, when President Donald Trump nominated Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. This move, long-telegraphed by the administration but still jarring to global markets, marks the beginning of what analysts are calling the

Via MarketMinute · February 12, 2026

The U.S. labor market just delivered a thunderclap that has reverberated from the halls of the Federal Reserve to the trading floors of Wall Street. In a stunning reversal of the "cooling" narrative that dominated the final months of 2025, the January jobs report released this morning revealed that

Via MarketMinute · February 12, 2026

In a year when OpenAI, Anthropic, and SpaceX could all go public, this IPO-focused fund deserves a look.

Via The Motley Fool · February 12, 2026

XRP (CRYPTO: XRP) has gained 9% over the past seven days, outperforming much of the broader crypto market, as institutional developments and ecosystem upgrades boosted

Via Benzinga · February 12, 2026

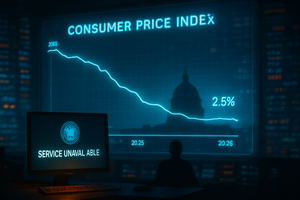

As the calendar turns to mid-February 2026, the American economy stands at a critical juncture. Investors and policymakers are fixated on the upcoming release of the January Consumer Price Index (CPI) report, which is widely anticipated to show a year-over-year inflation rate of 2.5%. This follows a cooling trend

Via MarketMinute · February 12, 2026

As the first quarter of 2026 unfolds, the technology sector is asserting its dominance with a vigor that has caught even the most optimistic market spectators by surprise. Following a two-year period characterized by what analysts described as a "necessary digestion" of the explosive gains from the early 2020s, the

Via MarketMinute · February 12, 2026

As the global economy stabilizes into a period of disinflationary growth, Goldman Sachs (NYSE: GS) has released a robust 2026 stock market outlook, forecasting a 12% total return for the S&P 500. This optimistic projection, which places the index target between 7,200 and 7,600 by year-end, suggests

Via MarketMinute · February 12, 2026

Via Benzinga · February 12, 2026

The financial world witnessed a watershed moment on January 28, 2026, as the S&P 500 index breached the 7,000-point threshold for the first time in history. This milestone, coming just fourteen months after the index crossed the 6,000 mark in November 2024, underscores the relentless momentum of

Via MarketMinute · February 12, 2026

The financial markets were sent into a tailspin on Thursday as S&P Global (NYSE: SPGI) saw its shares slump by nearly 10%, marking one of its steepest single-day declines in recent years. The sell-off was ignited by the company’s release of its 2026 profit forecast, which fell significantly

Via MarketMinute · February 12, 2026

Via MarketBeat · February 12, 2026

As of February 12, 2026, CBRE Group (NYSE: CBRE) stands at a critical crossroads. As the world’s largest commercial real estate (CRE) services and investment firm, it has long been the primary bellwether for global property markets. Today, however, the company is navigating a complex transition. While the firm just reported record-breaking earnings for fiscal [...]

Via Finterra · February 12, 2026

In a resounding display of market dominance, shares of Spotify (NYSE: SPOT) surged 14.7% this week, closing at $476.02 after the company released a blockbuster fourth-quarter 2025 earnings report. The rally, which added billions to the company’s market capitalization, was fueled by record-breaking user acquisition and a

Via MarketMinute · February 12, 2026

In a move that signals a seismic shift in U.S. monetary policy, President Donald Trump has formally nominated Kevin Warsh to serve as the next Chair of the Federal Reserve. The announcement, made in late January 2026, sets the stage for a transition of power at the world’s

Via MarketMinute · February 12, 2026

As of February 12, 2026, Robinhood Markets (NASDAQ: HOOD) has officially shed its reputation as a mere "meme stock" platform, evolving into a sophisticated financial titan that dominates the retail landscape. Once defined by the chaotic trading of 2021, the company has spent the last two years executing a rigorous strategic pivot. By diversifying its [...]

Via Finterra · February 12, 2026

Date: February 12, 2026 Introduction In the rapidly evolving architecture of the digital world, Cloudflare, Inc. (NYSE: NET) has transitioned from being a mere "protector of websites" to the essential nervous system of the global internet. As of early 2026, the company finds itself at the epicenter of two massive secular shifts: the decentralization of [...]

Via Finterra · February 12, 2026

NEW YORK — A tectonic shift in the global financial architecture reached a historic climax in 2025 and the opening weeks of 2026, as total global gold demand surged past an unprecedented 5,000 tonnes. This "Golden Era" is being spearheaded by an aggressive, structural pivot by central banks—led by

Via MarketMinute · February 12, 2026

As of February 12, 2026, Lyft, Inc. (NASDAQ: LYFT) finds itself at a pivotal crossroads. After years of living in the shadow of its larger rival, Uber, the San Francisco-based company has spent the last 24 months undergoing a fundamental transformation. No longer just a "second-place" rideshare app, Lyft has evolved under CEO David Risher [...]

Via Finterra · February 12, 2026

A new all-in-one app helps digital creators manage workflow, as the creator economy continues its rapid expansion and more individuals move from content creation into digital entrepreneurship.

Via Press Release Distribution Service · February 12, 2026

The company also named DHL as its logistics partner for aftermarket services across Northwestern Europe.

Via Stocktwits · February 12, 2026