News

The ETF's returns have been flat this year, as growth stocks have been struggling of late.

Via The Motley Fool · February 10, 2026

The iShares Core High Dividend ETF is up 12% this year.

Via The Motley Fool · February 10, 2026

The tech stock has been falling, despite posting another strong quarter.

Via The Motley Fool · February 10, 2026

These funds both pay more than 3% and have been beating the market this year.

Via The Motley Fool · February 10, 2026

Principal (PFG) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 10, 2026

The Japanese stock market reached a historic milestone on February 10, 2026, as the Nikkei 225 index surged to an all-time high of 58,000, capping a spectacular rally that has fundamentally redefined Japan’s position in the global financial landscape. This surge, fueled by a landslide victory for the

Via MarketMinute · February 10, 2026

The benchmark 10-year U.S. Treasury yield plummeted to 4.14% on Tuesday, February 10, 2026, as investors aggressively repositioned for a more dovish Federal Reserve following a starkly disappointing retail sales report. The move represents a significant departure from the 4.30% levels seen earlier this year, signaling that

Via MarketMinute · February 10, 2026

Explore how expense structure and portfolio concentration set these two short-term bond ETFs apart for conservative investors.

Via The Motley Fool · February 10, 2026

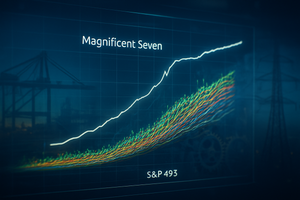

As of February 10, 2026, the long-standing "two-speed" economy that defined the post-pandemic era has finally reached a historic turning point. For years, a handful of mega-cap technology titans—the "Magnificent Seven"—carried the weight of the entire U.S. stock market on their shoulders, while the remaining 493 companies

Via MarketMinute · February 10, 2026

Smaller stocks and value equities are displaying leadership traits, indicating investors may want to allocate $1,000 (or more) to this Vanguard ETF.

Via The Motley Fool · February 10, 2026

Explore how differences in cost, yield, and sector focus set these two consumer ETFs apart for investors with distinct priorities.

Via The Motley Fool · February 10, 2026

Weighing cost, scale, and portfolio focus, these ETFs take distinctly different approaches to investment-grade bond exposure.

Via The Motley Fool · February 10, 2026

U.S.

Via Benzinga · February 10, 2026

As of February 10, 2026, S&P Global Inc. (NYSE: SPGI) finds itself at a pivotal crossroads. Long regarded as the "gold standard" of financial market infrastructure, the company recently reported a robust set of fiscal year 2025 results, only to see its stock face immediate pressure due to conservative forward guidance. This paradox—strong historical performance [...]

Via Finterra · February 10, 2026

As of February 10, 2026, Palantir Technologies (NYSE: PLTR) has transitioned from a controversial, niche "black box" of the intelligence community to one of the most influential forces in the global enterprise software and Artificial Intelligence (AI) sectors. Long regarded with skepticism by Wall Street for its unconventional leadership and heavy reliance on government contracts, [...]

Via Finterra · February 10, 2026

Key differences in cost, risk, and asset size set these two precious metals ETFs apart for investors seeking portfolio diversification.

Via The Motley Fool · February 10, 2026

Despite CME Group's strong performance relative to the broader market over the past year, Wall Street analysts remain cautiously optimistic about the stock’s prospects.

Via Barchart.com · February 10, 2026

Via Benzinga · February 10, 2026

Via Benzinga · February 10, 2026

Bitcoin is tanking, but there’s another way to play crypto. And it's been working better for 12 months.

Via Barchart.com · February 10, 2026

After gaining 34% in 2025, emerging markets extend their rally in 2026, with ETFs up double digits and analysts pointing to dollar weakness, tech exposure and accelerating earnings.

Via Benzinga · February 10, 2026

As Carvana has exceeded the broader market over the past year, Wall Street analysts maintain a strongly optimistic outlook on the stock’s prospects.

Via Barchart.com · February 10, 2026

At the time of writing, the Dow Jones Industrial Average index traded 0.5% higher, at 50,430 points, and the S&P 500 index edged up to 6,966 points.

Via Stocktwits · February 10, 2026

Via Benzinga · February 10, 2026

Vanguard offers a wide array of quality, ultra-cheap ETFs that are great for investors. But I'd steer clear of this one in particular.

Via The Motley Fool · February 10, 2026