Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

West Texas Intermediate Oil price declines after two days of gains, trading around $63.50 per barrel during the Asian hours on Thursday.

Via Talk Markets · February 5, 2026

Total earnings for the 236 S&P 500 members that have reported Q4 results are up +12.6% from the same period last year on +8.2% higher revenues, with 81.8% beating EPS estimates and 70.8% beating revenue estimates.

Via Talk Markets · February 5, 2026

The USD/CHF pair holds positive ground near 0.7780 during the early European session on Thursday, bolstered by renewed US Dollar demand.

Via Talk Markets · February 5, 2026

The Japanese Yen languishes near a two-week low against a firmer US Dollar during the Asian session on Thursday and seems vulnerable to prolonging the downtrend witnessed over the past week or so.

Via Talk Markets · February 5, 2026

These top-rated stocks have been suitable candidates for the portfolio and are certainly going to draw investors' interest after their favorable Q4 results...

Via Talk Markets · February 5, 2026

Volatility spiked as traders

Via Talk Markets · February 4, 2026

The oil markets had a green day today.

Via Talk Markets · February 4, 2026

An overview of the potential opportunity in rare earth minerals, emphasizing geopolitical shifts,

Via Talk Markets · February 4, 2026

A sudden silver price meltdown has ignited a global physical buying frenzy, leading to widespread supply chain breakdowns and record premiums. As investors rush to secure bullion, dealers face depleted inventories and significant delivery delays.

Via Talk Markets · February 5, 2026

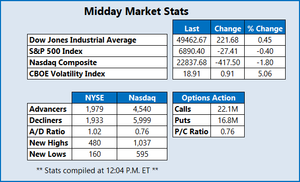

Stock market rotation out of software and tech in general was on clear display today, with the tech-heavy Nasdaq and Nasdaq-exposed S&P 500 hitting the closing bell lower by -1.51% and -0.51%, respectively.

Via Talk Markets · February 4, 2026

In this video, Ira Epstein discusses the current challenges and dynamics in the financial markets, highlighting the significant downturn in tech stocks despite strong performance metrics, exemplified by AMD's recent losses.

Via Talk Markets · February 4, 2026

Alphabet shares experienced a rare post-earnings “hiccup” on Wednesday, as investors grappled with a massive spike in projected capital expenditures and a slight miss in YouTube advertising revenue.

Via Talk Markets · February 4, 2026

Gold price (XAU/USD) jumps to around $5,005 during the early Asian session on Thursday.

Via Talk Markets · February 4, 2026

U.S. stocks could be in for a

Via Talk Markets · February 4, 2026

The massive correction and the associated sales have noticeably defused the previously tense situation in the physical silver market.

Via Talk Markets · February 4, 2026

LCNB has declared and paid variable quarterly dividends since March 2000. The December 2025 Q dividend of $0.22 suggests $0.88 annual dividend for the coming year.

Via Talk Markets · February 4, 2026

GBP/USD remains trapped in a near-term cycling pattern on Wednesday, continuing to churn aimlessly between 1.3700 and 1.3650.

Via Talk Markets · February 4, 2026

Truflation’s Chief Economist reports a dramatic drop in inflation, now estimated below 1%. While official data remains delayed, this real-time gauge suggests a rapid cooling, potentially challenging the Fed’s current

Via Talk Markets · February 4, 2026

The S&P 500 price return was 17% in 2025. However, over the same period, an unhedged Euro investment in the S&P 500 only returned 1%, without counting dividends.

Via Talk Markets · February 4, 2026

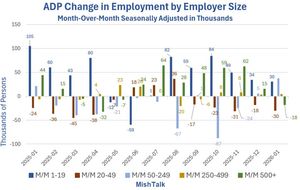

ADP data shows the manufacturing sector remains in a deep freeze, with jobs declining for 22 consecutive months. While some hope for a recovery, the persistent contraction in goods-producing roles contrasts sharply with steady service expansion.

Via Talk Markets · February 4, 2026

Hercules Capital is a business development company based in San Mateo, California, that lends money to entrepreneurs and venture capital investors.

Via Talk Markets · February 4, 2026

Stocks fell on Wednesday, but the S&P 500 declined by only 50 basis points. However, the S&P 500 equal-weight ETF RSP rose by nearly 90 bps, which is notable dispersion today.

Via Talk Markets · February 4, 2026

EUR/USD dips as strong US services PMI data supports the Dollar despite emerging labor market softness.

Via Talk Markets · February 4, 2026

The Nasdaq just breached the lower edge of its expected move. The Dow is pushing the upper edge of its expected move. That divergence tells you everything about what's happening right now.

Via Talk Markets · February 4, 2026

Although heavy duty truck sales rebounded somewhat in December, up from their post-pandemic low of 336,000 annualized in November to 392,000, even on a three month average basis they are down -3.4% from their peak in 2023.

Via Talk Markets · February 4, 2026

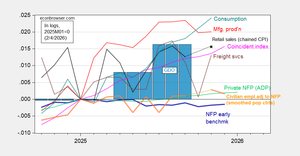

+22K vs. consensus of +46K, down from December (rev’d) +37K. Alternative business cycle indicators incorporating these figures show the labor market growth at near zero:

Via Talk Markets · February 4, 2026

The markets are struggling to estimate and price in risk, but there are powerful forces working against genuine price discovery.

Via Talk Markets · February 4, 2026

EPS $2.82, up 31% vs. $2.15 y/y, beating estimate $2.65.

Via Talk Markets · February 4, 2026

GBP/USD traded around 1.3712, holding above its rising 20-day exponential moving average at 1.3605, with a 14-day RSI at 62.

Via Talk Markets · February 4, 2026

Ethereum price defends the $2,000 support zone as analysts watch $2,400 and $2,700 levels for signs of trend recovery.

Via Talk Markets · February 4, 2026

The Nasdaq and S&P 500 extended yesterday's losses, with the former falling 350 points as Advanced Micro Device's dismal outlook dragged chip stocks.

Via Talk Markets · February 4, 2026

Advanced Micro Devices stock has had heavy, unusual trading in short-term out-of-the-money call options today. Based on the company's strong earnings results yesterday, it could be a bullish signal for AMD stock.

Via Talk Markets · February 4, 2026

Valued at $18.64 billion, US Foods is a food service distributor. The company serves independent and multi-unit restaurants, healthcare and hospitality entities, and government and educational institutions.

Via Talk Markets · February 4, 2026

Witness the destruction of businesses with 20-49 employees.

Via Talk Markets · February 4, 2026

Canada’s private-sector activity remained soft in January, with the S&P Global Canada Composite PMI coming in at 46.4, slightly below December’s 46.7.

Via Talk Markets · February 4, 2026

Several analysts cut their price targets on Qualcomm ahead of its quarterly print.

Via Talk Markets · February 4, 2026

Despite mounting concerns over AI's long-term sustainability, the sector's expansion shows no signs of slowing.

Via Talk Markets · February 4, 2026

CAD trades near 1.3635 against USD on Wednesday, little changed from the previous session.

Via Talk Markets · February 4, 2026

Private credit has billions tied up in software companies that are about to be exponentially wiped out.

Via Talk Markets · February 4, 2026

Beyond being a familiar adage, “quality over quantity” lies at the heart of quality-based investing.

Via Talk Markets · February 4, 2026

While eurozone inflation has dropped below 2%, medium-term inflation expectations are not softening.

Via Talk Markets · February 4, 2026

January private data reveals a stalling labor market, with ADP reporting only 22k new jobs and manufacturing losing 159k annually. While ISM Services (53.8) signals expansion, rising prices paid hint at persistent pipeline inflation.

Via Talk Markets · February 4, 2026

Gold and silver investors have just lived through one of the most violent and disorderly corrections in modern market history.

Via Talk Markets · February 4, 2026

As the race for artificial intelligence reaches a fever pitch, the physical infrastructure of the datacenter has hit a trifecta of constraints.

Via Talk Markets · February 4, 2026

Estee Lauder stock price has staged a strong comeback in the past few months, moving from a low of $48 in April last year to the current $116.

Via Talk Markets · February 4, 2026

Bitcoin price tests major support after a liquidity sweep as volatility rises, with $78K–$80K in focus if stabilization holds.

Via Talk Markets · February 4, 2026

Roblox stock price has remained in a freefall this year, moving from a record high of over $150 in July last year to the current $65.

Via Talk Markets · February 4, 2026

NZD/USD trades around 0.6000 on Wednesday at the time of writing, down 0.90% on the day, as investors digest mixed New Zealand labor market data and an uncertain global macroeconomic environment.

Via Talk Markets · February 4, 2026

All eyes are on Amazon Web Services as the tech behemoth warms up to report its fourth-quarter earnings on February 5th.

Via Talk Markets · February 4, 2026

Technical analysis on the stock chart for IBM.

Via Talk Markets · February 4, 2026

I talk about “the biggest economic trends of the past year and explain how rising tariffs are shaping prices, business decisions, and household budgets.”

Via Talk Markets · February 4, 2026

The S&P 500 is heading for its fifth loss in the last six sessions, as investors continue to rotate out of tech and weigh the latest labor market reading.

Via Talk Markets · February 4, 2026

Natural gas production has rebounded from recent freeze-offs but still lags nearly 4 BCF per day behind the record levels seen in December.

Via Talk Markets · February 4, 2026

Quantum industry CAGR is 36.9% through 2030, eyeing 5,000 operational units. Despite long-term growth, the sector continued its decline in January.

Via Talk Markets · February 4, 2026

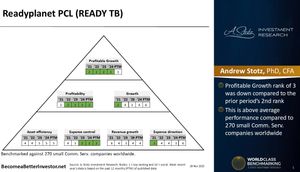

Readyplanet Public Company Limited provides an All-in-One Sales and Marketing Platform for businesses across Thailand.

Via Talk Markets · February 4, 2026

Novo Nordisk shares tumbled 18% after the company issued unexpectedly weak 2026 guidance, forecasting sales could decline as much as 13%.

Via Talk Markets · February 4, 2026

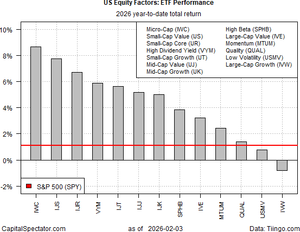

There have been multiple false dawns in recent years as large caps and growth stocks regained the performance crown after a burst of small-cap strength.

Via Talk Markets · February 4, 2026

We expect headline inflation to fall to 1.8% in April from 3.4% in December, a much faster pullback than the Bank of England is forecasting. It's another reason to think the Bank has more work to do. We expect rate cuts in March and June

Via Talk Markets · February 4, 2026

Japan’s rising yields and currency volatility reflect an economic normalization.

Via Talk Markets · February 4, 2026

Crude oil prices are trending moderately lower this morning as traders weigh geopolitical tensions in the Middle East and a report of sharply lower US stockpiles reported by API overnight.

Via Talk Markets · February 4, 2026

Although the benchmark indices opened higher, they traded positively throughout the session and ultimately closed flat.

Via Talk Markets · February 4, 2026

Market jitters over the sustainability of AI demand and a broader rotation out of high-flying tech stocks have eclipsed Advanced Micro Devices' stellar fourth-quarter earnings.

Via Talk Markets · February 4, 2026

ADP's Employment report paints a poor picture for hiring (even if jobless claims paints a healthy picture for 'not firing'), adding just 22k jobs (well below the 45k expected).

Via Talk Markets · February 4, 2026

The EUR/USD turned lower after starting the session on the front-foot.

Via Talk Markets · February 4, 2026

With artificial intelligence dominating investors’ thoughts, there is a constant search for investment ideas to profit from the AI boom.

Via Talk Markets · February 4, 2026

The major currency pair is engaged in recovery attempts. On Wednesday, EUR/USD strengthened to 1.1822.

Via Talk Markets · February 4, 2026

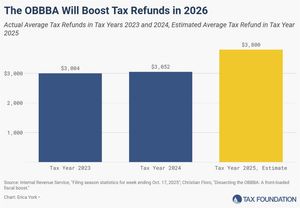

The Tax Foundation estimates refunds will be $748 more per household, on average, compared to last year.

Via Talk Markets · February 4, 2026

Bitcoin has shown resilience by holding the key $74,000 breakout pullback level from April 2025 and the $73,000 highs.

Via Talk Markets · February 4, 2026

Quarterly earnings reveal a mix of positive surprises and challenges, with Eli Lilly and AbbVie beating expectations and Uber facing hurdles.

Via Talk Markets · February 4, 2026

Semiconductor giant Nvidia has long been the darling of the artificial intelligence boom on Wall Street, but AMD’s rip-roaring start to 2026 shows investors that there could be a major market opportunity emerging.

Via Talk Markets · February 4, 2026

McDonald’s has broken March 2025 highs, aiming for 340 as Wave C unfolds, though the rally may be nearing its final stage.

Via Talk Markets · February 4, 2026

Gold, on Wednesday, returned above the key level of 5000 USD per ounce and has already approached 5067 USD.

Via Talk Markets · February 4, 2026

Chipotle reported another disappointing quarter after the close on Tuesday with -2.5% comps. For the first time ever, full year comps were negative at -1.7%.

Via Talk Markets · February 4, 2026

Sunday’s election is around the corner and polls show Prime Minister Takaichi leading the LDP to a strong showing, where it may recapture an outright majority.

Via Talk Markets · February 4, 2026