PubMatic’s stock price has taken a beating over the past six months, shedding 30.7% of its value and falling to $9.98 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in PubMatic, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're cautious about PubMatic. Here are three reasons why there are better opportunities than PUBM and a stock we'd rather own.

Why Is PubMatic Not Exciting?

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

1. Long-Term Revenue Growth Disappoints

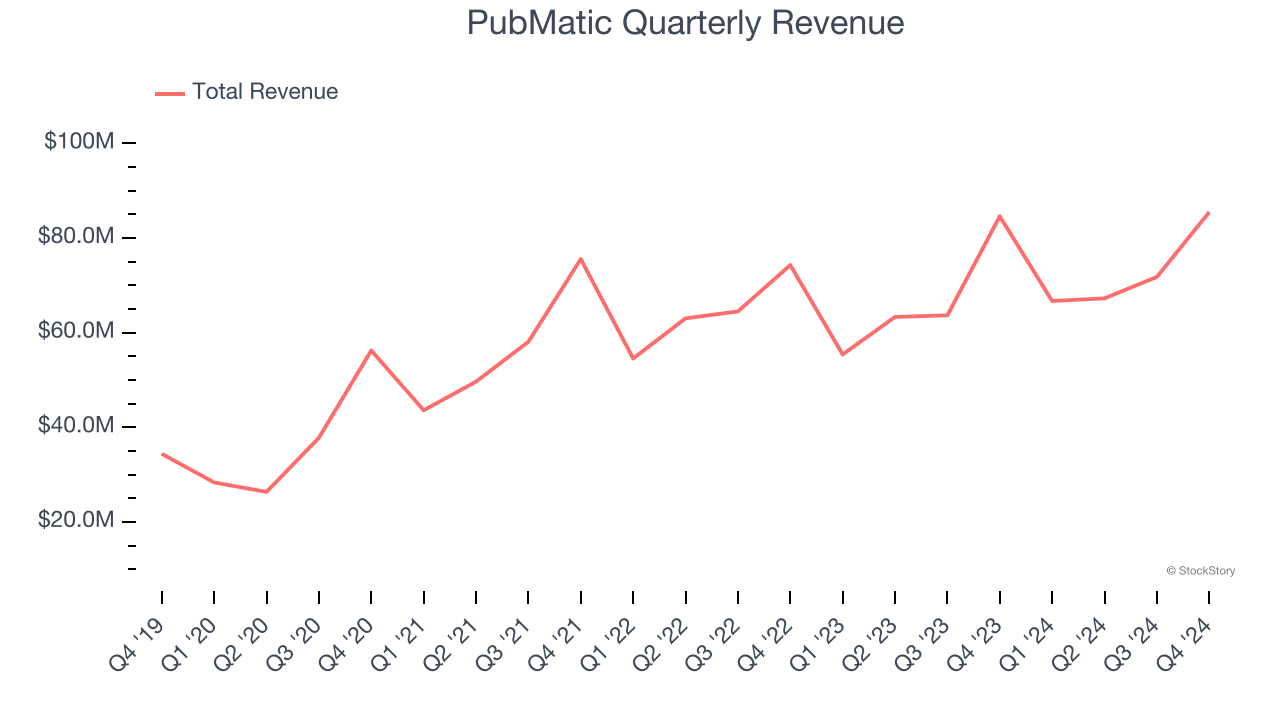

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, PubMatic grew its sales at a sluggish 8.7% compounded annual growth rate. This was below our standard for the software sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect PubMatic’s revenue to rise by 2.6%, a deceleration versus its 8.7% annualized growth for the past three years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

3. Low Gross Margin Reveals Weak Structural Profitability

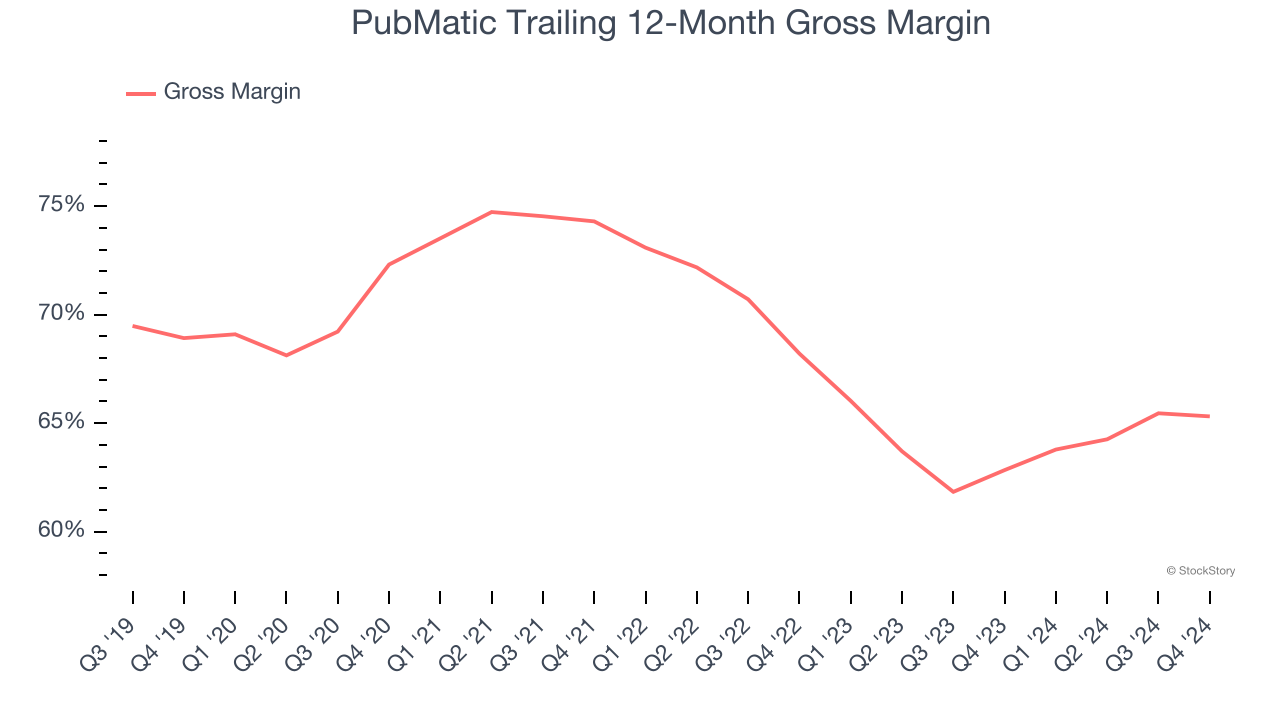

For software companies like PubMatic, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

PubMatic’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 65.3% gross margin over the last year. Said differently, PubMatic had to pay a chunky $34.69 to its service providers for every $100 in revenue.

Final Judgment

PubMatic’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 1.7× forward price-to-sales (or $9.98 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of PubMatic

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.