Although the S&P 500 is down 1.4% over the past six months, Utz’s stock price has fallen further to $13.89, losing shareholders 19.4% of their capital. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Utz, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Even with the cheaper entry price, we're cautious about Utz. Here are three reasons why we avoid UTZ and a stock we'd rather own.

Why Do We Think Utz Will Underperform?

Tracing its roots back to 1921 when Bill and Salie Utz began making potato chips in their kitchen, Utz Brands (NYSE:UTZ) offers salty snacks such as potato chips, tortilla chips, pretzels, cheese snacks, and ready-to-eat popcorn, among others.

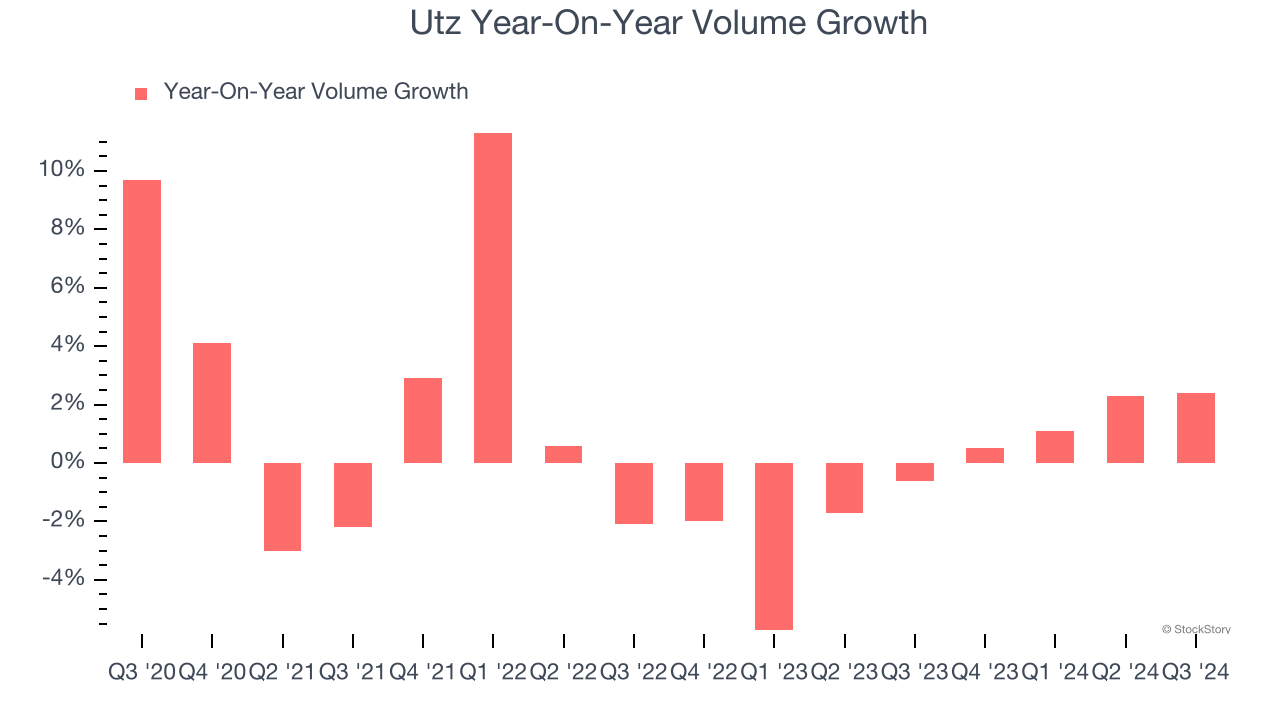

1. Sales Volumes Stall, Demand Waning

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Utz’s quarterly sales volumes have, on average, stayed about the same over the last two years. This stability is normal because the quantity demanded for consumer staples products typically doesn’t see much volatility.

2. Fewer Distribution Channels Limit its Ceiling

With $1.41 billion in revenue over the past 12 months, Utz is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Utz historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

Final Judgment

We see the value of companies helping consumers, but in the case of Utz, we’re out. Following the recent decline, the stock trades at 16.6× forward price-to-earnings (or $13.89 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Utz

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.