Wrapping up Q4 earnings, we look at the numbers and key takeaways for the immuno-oncology stocks, including Natera (NASDAQ:NTRA) and its peers.

Over the next few years, immuno-oncology companies, which harness the immune system to fight illnesses such as cancer, faces strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 4 immuno-oncology stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 3.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.9% since the latest earnings results.

Best Q4: Natera (NASDAQ:NTRA)

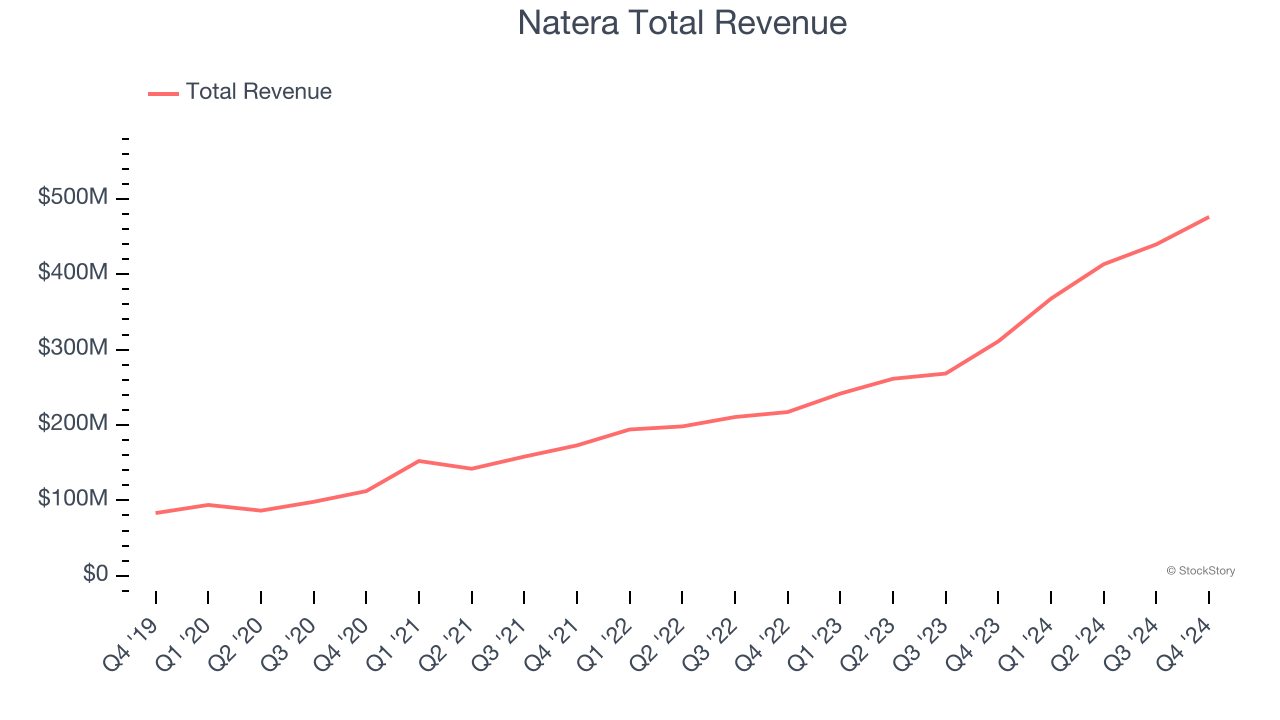

Founded in 2003 as Gene Security Network before rebranding in 2012, Natera (NASDAQ:NTRA) develops and commercializes genetic tests for prenatal screening, cancer detection, and organ transplant monitoring using its proprietary cell-free DNA technology.

Natera reported revenues of $476.1 million, up 53% year on year. This print exceeded analysts’ expectations by 8.6%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

“We had a strong finish to the year, with excellent performance across the board,” said Steve Chapman, chief executive officer of Natera.

Natera scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 3.6% since reporting and currently trades at $151.02.

Read why we think that Natera is one of the best immuno-oncology stocks, our full report is free.

Exact Sciences (NASDAQ:EXAS)

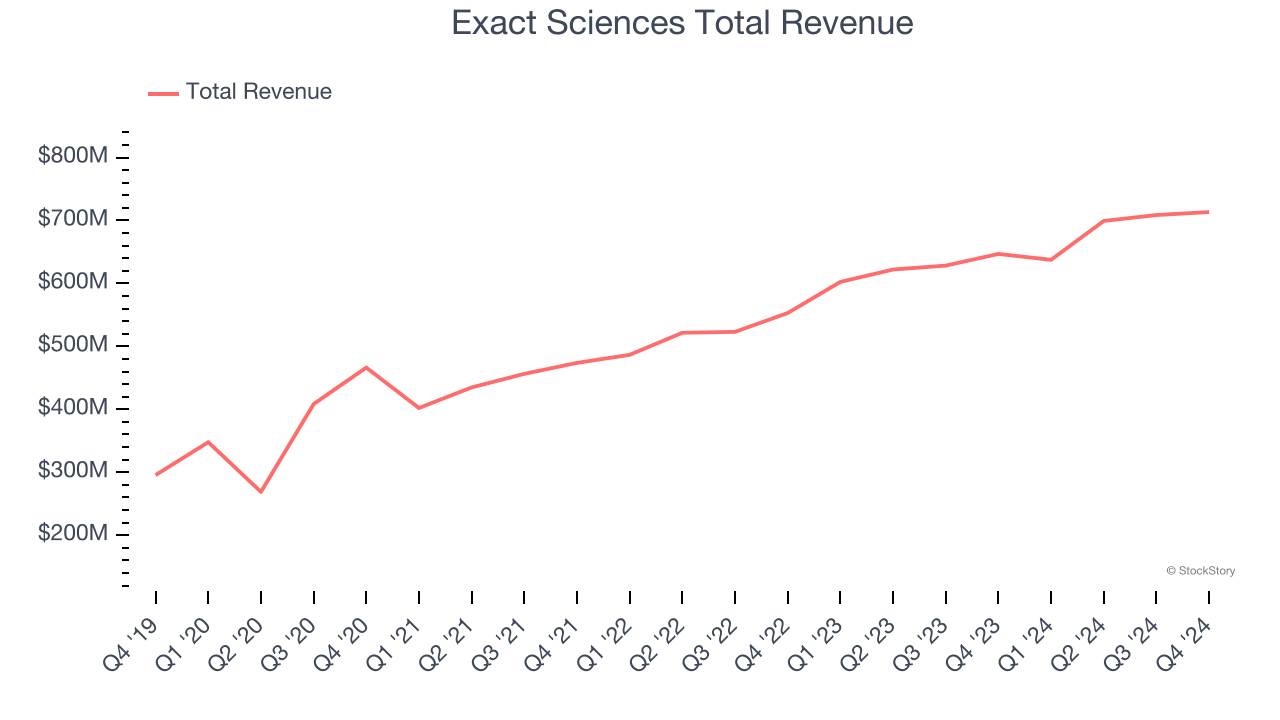

With a mission to detect cancer earlier when it's more treatable, Exact Sciences (NASDAQ:EXAS) develops and markets cancer screening and diagnostic tests, including its flagship Cologuard stool-based colorectal cancer screening test.

Exact Sciences reported revenues of $713.4 million, up 10.3% year on year, outperforming analysts’ expectations by 1.6%. The business had a strong quarter with a solid beat of analysts’ constant currency revenue estimates and an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 8.5% since reporting. It currently trades at $46.16.

Is now the time to buy Exact Sciences? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Incyte (NASDAQ:INCY)

Founded in 1991 and evolving from a genomics research firm to a commercial-stage drug developer, Incyte (NASDAQ:INCY) is a biopharmaceutical company that discovers, develops, and commercializes proprietary therapeutics for cancer and inflammatory diseases.

Incyte reported revenues of $1.18 billion, up 16.3% year on year, exceeding analysts’ expectations by 3%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 16.8% since the results and currently trades at $61.69.

Read our full analysis of Incyte’s results here.

Regeneron (NASDAQ:REGN)

Founded by scientists who wanted to build a company where science could thrive, Regeneron Pharmaceuticals (NASDAQ:REGN) develops and commercializes medicines for serious diseases, with key products treating eye conditions, allergic diseases, cancer, and other disorders.

Regeneron reported revenues of $3.79 billion, up 10.3% year on year. This print surpassed analysts’ expectations by 1%. It was a strong quarter as it also put up a decent beat of analysts’ EPS estimates.

Regeneron had the weakest performance against analyst estimates among its peers. The stock is up 1.5% since reporting and currently trades at $675.99.

Read our full, actionable report on Regeneron here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.