Since September 2024, Luxfer has been in a holding pattern, posting a small loss of 3% while floating around $12.12.

Is there a buying opportunity in Luxfer, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We don't have much confidence in Luxfer. Here are three reasons why there are better opportunities than LXFR and a stock we'd rather own.

Why Do We Think Luxfer Will Underperform?

With its magnesium alloys used in the construction of the famous Spirit of St. Louis aircraft, Luxfer (NYSE:LXFR) offers specialized materials, components, and gas containment devices to various industries.

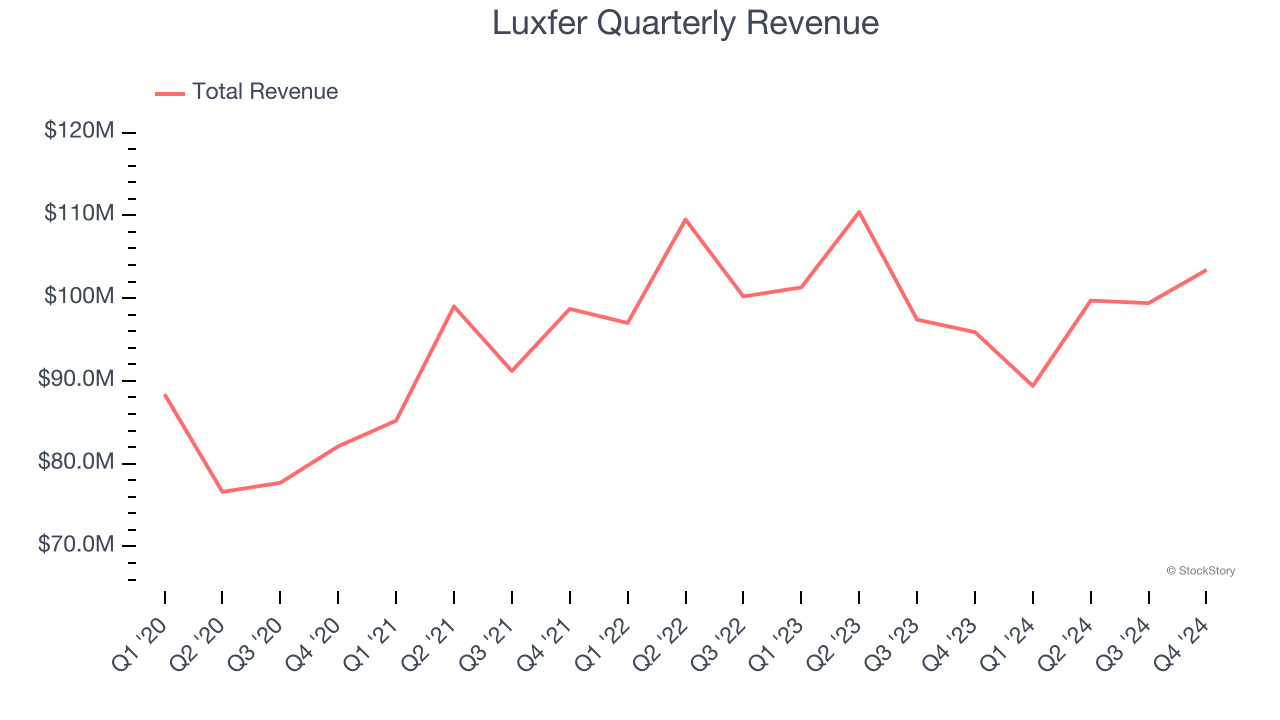

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last four years, Luxfer grew its sales at a tepid 4.8% compounded annual growth rate. This was below our standard for the industrials sector.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Luxfer’s revenue to stall. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

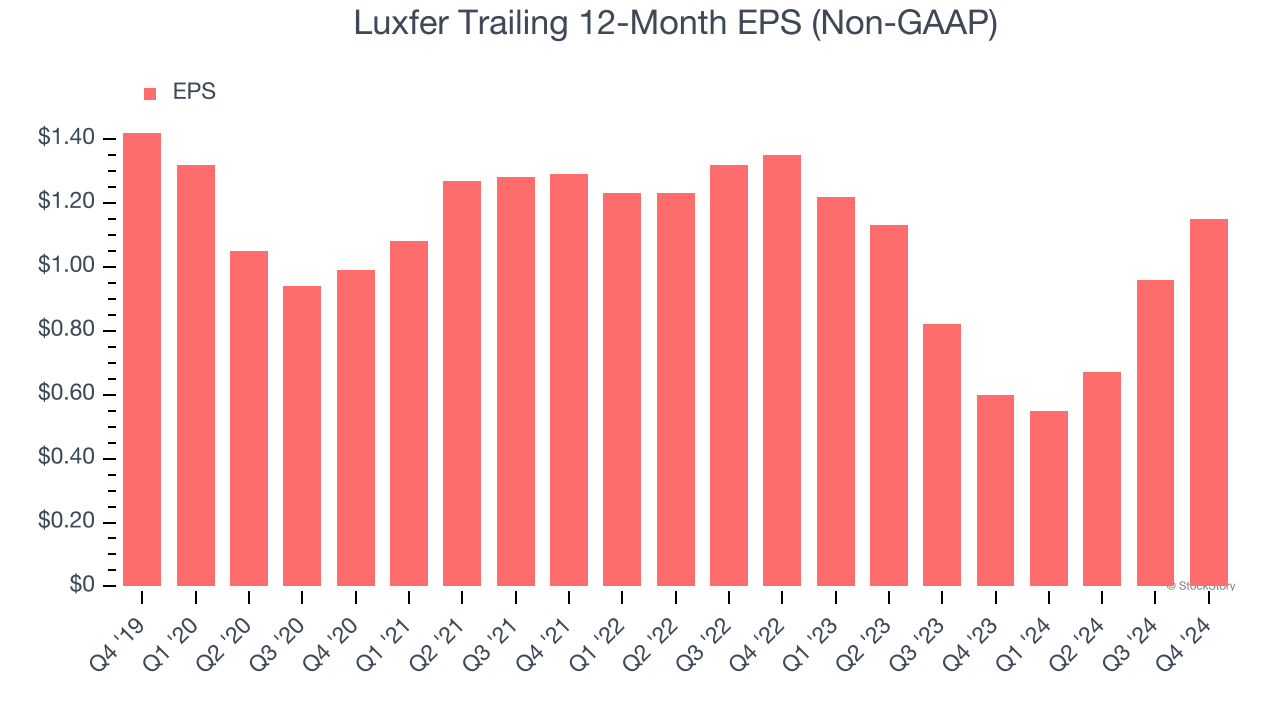

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Luxfer’s full-year EPS dropped 22.4%, or 4.1% annually, over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Luxfer’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Luxfer doesn’t pass our quality test. That said, the stock currently trades at 11.7× forward price-to-earnings (or $12.12 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Luxfer

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.