Toronto, Ontario--(Newsfile Corp. - December 22, 2025) - Kuya Silver Corporation (CSE: KUYA) (OTCQB: KUYAF) (FSE: 6MR1) (the "Company" or "Kuya Silver") is pleased to report exploration results from the Umm-Hadid Project in Saudi Arabia, including assay results from surface grab samples and the first phase of diamond drilling (approximately 5000 m). The Umm Hadid project is owned by Silver Mining LLC and is a joint venture between Sumou Holding and Kuya Silver. Results confirm the presence of high-grade silver-gold mineralization across multiple target areas spread over a large area (6 km x 2.5 km).

Drill Highlights:

A total of 5001.58 metres drilled across 29 diamond drill holes (25-UH-001 to 25-UH-029) with an average depth of 177 m and a maximum depth of 351 m.

Drilling confirms high-grade silver-gold mineralization previously identified with grab samples in 3 target areas.

Highlighted Drill Intercepts:

Hole 25-UH-010; 2.0 m grading 1483.9 g/t AgEq (3.8 g/t Au and 1227 g/t Ag) from 52 to 54 m

Hole 25-UH-011; 2.0 m grading 248.5 g/t AgEq (2.6 g/t Au and 108.1 g/t Ag) from 94 to 96 m

Hole 25-UH-012; 1.0 m grading 632.5 g/t AgEq (0.9 g/t Au and 569 g/t Ag) from 95 to 96 m

Hole 25-UH-014; 1.0 m grading 389.6 g/t AgEq (0.2 g/t Au and 376 g/t Ag) from 83 to 84 m

Hole 25-UH-018; 2.0 m grading 718 g/t AgEq (3.0 g/t Au and 514.5 g/t Ag) from 87 to 89 m

Surface Sample Highlights:

A total of 460 grab samples taken across the property with an arithmetic average of 86.10 g/t AgEq*

Highest grade sample 1359.82 g/t AgEq* (1.60 g/t Au and 1250 g/t Ag)

167 samples grade >50 g/t AgEq*; 117 samples grade >0.5 g/t Au; 118 samples grade >50 g/t Ag

Strong correlation between Au and Ag in samples widely distributed within an area of 6 by 2.5 km suggest a large scale precious-metal rich hydrothermal system.

The spatial distribution of best sample assays defines 3 targets of major interest

Osbaldo Zamora, Kuya Silver's Vice President Exploration, commented: "The success of our maiden 5,000-meter drilling program at Umm Hadid is a significant milestone for the Umm Hadid Project. By integrating hyperspectral remote sensing and AI-driven targeting, we have successfully identified and intercepted high-grade mineralization in several multi-kilometre structural corridors within the large 240 km2 license area. Achieving these results—highlighted by silver grades of up to 1,275 g/t and gold grades up to 10.53 g/t—in our very first pass of drilling suggests a strong cost-benefit to our modern technological approach to exploration. We have not only discovered a core consisting of higher-grade precious metals veins but have also validated a predictive model that we believe can be applied across the entire district, significantly reducing risk and maximizing capital efficiency as we move to expand this discovery."

Exploration Program Overview

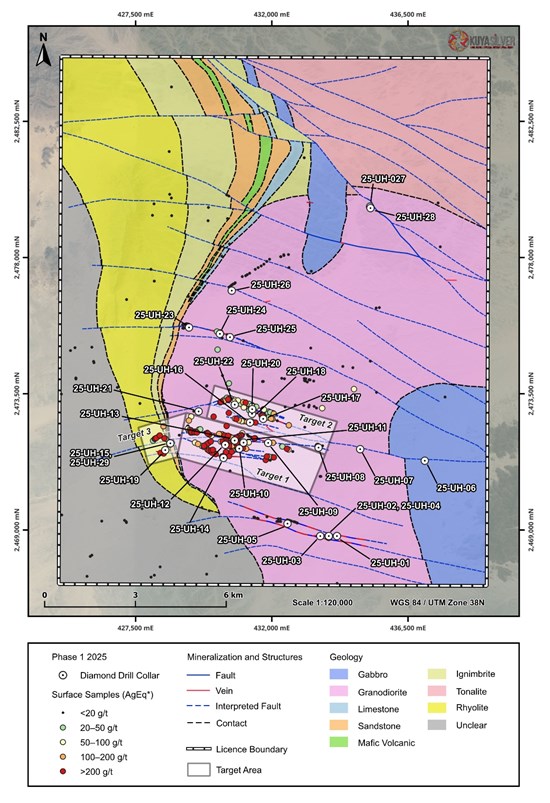

Surface mapping and sampling (460 samples), ground geophysics, and satellite imagery analysis was conducted across the entire property by the technical team and consultants as part of the 2025 ongoing exploration program at Umm Hadid. Based on this work, several different areas across the property were selected and tested with a 5,000 m diamond drill program resulting in 3 targets of major interest (Figure 1). Best drilling intersects are shown in Table 1.

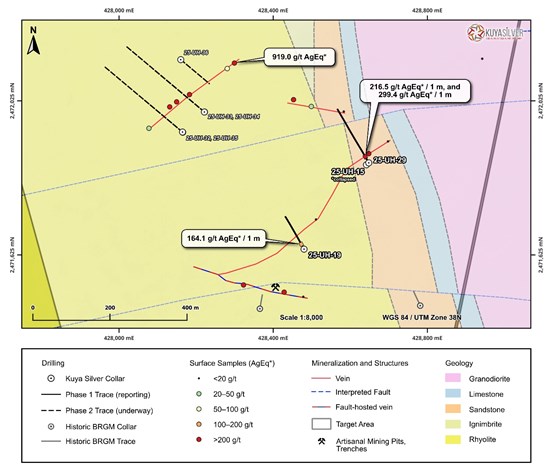

Figure 01. Map showing the geology interpreted based on geophysics and satellite imagery; surface samples results, drillhole collars location, and identified target areas.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/278796_0239ed84f425399a_001full.jpg

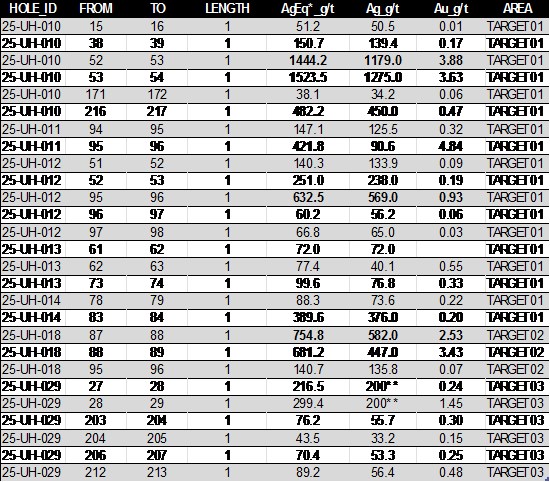

Table 01. Summary of best drillhole individual intervals and corresponding targets. AgEq* (silver equivalent) grades were calculated using $62.90 USD / oz silver and $4,301.05 USD / oz gold, with metal prices captured on December 12, 2025. The length represents the size of the core sample and do not reflect true width of the mineralized interval. 200** g/t samples in UH-029 note that the overlimit assays are pending.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/278796_0239ed84f425399a_002full.jpg

Exploration Strategy and Process

With such a large license area (240 km2) to explore, Silver Mining employed modern remote sensing methods driven with aspects of machine learning to quickly and cost-effectively gain an understanding of geology (rock types), structures, and alteration signatures to prioritize targets. Surface rock-chip sampling and the initial scout drilling program helped to further refine the areas of interest, which we have, for the time being, divided into three targets areas.

Target Descriptions

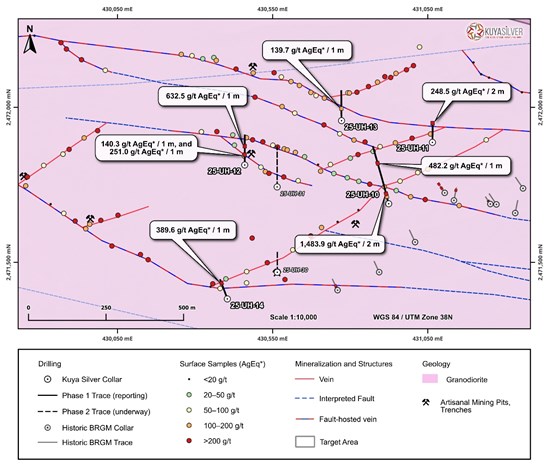

Target 01

Target 01 is defined by an area of 4.5 by 2.5 km that contains multiple veins and faults dominantly NW-trending with lesser NE-trending splays hosted by granodiorite. This vein system seems to be related to a sinistral strike-slip shared zone. Individual mineralized structures (faults/veins) have been tracked with surface samples for up to 3 km along strike. This target shows the highest concentration of grab samples with AgEq* above 50 g/t, as well as artisanal mining pits and few positive historic holes. This target was tested with 902.24 m of drilling across 6 holes (25-UH-009 to 25-UH-014) from which 5 holes confirmed mineralization in 18 intervals (Table 1; Figure 2). The best interval (in Hole 25-UH-010) yields 1483.9 g/t AgEq* (3.8 g/t Au and 1227 g/t Ag) over 2 meters.

Figure 2. Geological map showing target 01, surface samples, main drillhole intercepts, artisanal mines, and historic drillholes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/278796_0239ed84f425399a_003full.jpg

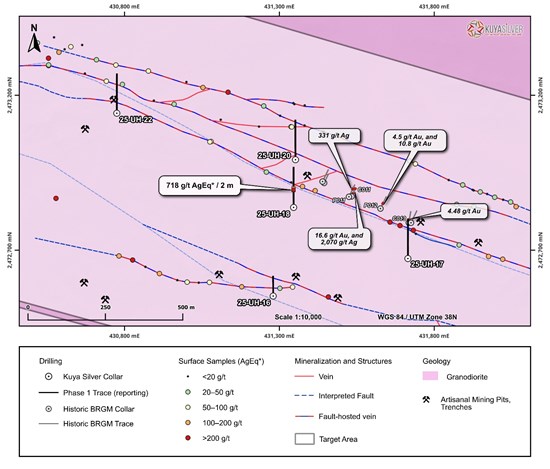

Target 02

The mineralization in Target 02, an area of 4 by 1 km, is also a structurally controlled by a sinistral strike slip sheared zone that runs parallel to Target 01 and exhibit similar characteristics and same host rock (granodiorite). Individual mineralized structures here were tracked along strike with surface samples for up to 2.3 km. This target was tested with 899.42 m across 5 holes, however only Hole 25-UH-018 returned significant mineralization (2m @ 718 g/t AgEq* (3 g/t Au and 514.5 g/t Ag) (Table 01; Figure 03).

Figure 3. Geological map showing target 02, surface samples, main drillhole intercepts, artisanal mines, and historic drillholes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/278796_0239ed84f425399a_004full.jpg

Target 03

The mineralization in Target 03, an area of 1.3 by 1 km, is controlled dominantly by NE-trending structures and is hosted by felsic rocks. This target was tested with 514 m of drilling in 3 holes but only Hole 25-UH-029 returned significant mineralization in 3 different intervals (Table 01; Figure 4). A NE-trending vein tracked along strike for at least 300 m with high-grade surface samples was not tested in phase 01 drill program and is currently being drilled. The best result from surface grab samples comes from that vein (1359.82 g/t AuEq*; 1.60 g/t Au and 1250 g/t Ag).

Figure 4. Geological map showing target 03, surface samples, main drillhole intercepts, artisanal mines, and historic drillholes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/278796_0239ed84f425399a_005full.jpg

Quality Assurance / Quality Control (QA/QC)

Drill core (HQ) samples were collected under the supervision of an experienced Silver Mining geologists and transported safely to a core logging facility for detailed logging and sampling. Samples were prepared using half core and securely shipped to Bureau Veritas Laboratories in Jeddah, Kingdom of Saudi Arabia for sample preparation, and analysis.

All samples were analyzed using four-acid digestion ICP-ES (code MA300) with Fire Assay and Gravimetric Finish (cores FA 430 and FA530, respectively) and standard industry procedures.

As part of the Company's QA/QC protocols, a robust quality control program was implemented, which includes the insertion of certified reference materials (standards), blank samples, and duplicate samples at regular intervals (approximately every 10 samples) throughout the sample stream. All QA/QC control samples returned results within acceptable limits, ensuring the reliability of the assay data.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Osbaldo Zamora, Ph.D., P.Geol., a Qualified Person as defined by National Instrument 43-101. Dr. Zamora is Vice President of Exploration for Kuya Silver and is not independent of the Company.

About Kuya Silver Corporation

Kuya Silver is a Canadian‐based, growth-oriented mining company with a focus on silver. Kuya Silver operates the Bethania silver mine in Peru, while developing district-scale silver projects in mining-friendly jurisdictions including Peru, Canada and Saudi Arabia.

About Silver Mining LLC

Silver Mining, based in the Kingdom of Saudi Arabia, is a private joint venture between majority shareholder, Saudi-based Sumou Holding (https://sumouholding.com), and Kuya Silver. Kuya Silver currently holds a 5% carried interest with an option to acquire an additional 40% participating interest in the company.

For more information, please contact:

David Stein, President and Chief Executive Officer

Telephone: (604) 398‐4493

info@kuyasilver.com

www.kuyasilver.com

Reader Advisory

This news release contains statements that constitute "forward-looking information," including statements regarding the plans, intentions, beliefs, and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words "may," "would," "could," "will," "intend," "plan," "anticipate," "believe," "estimate," "expect," "must," "next," "propose," "new," "potential," "prospective," "target," "future," "verge," "favorable," "implications," and "ongoing," and similar expressions, as they relate to the Company or its management, are intended to identify such forward-looking information. Investors are cautioned that statements including forward-looking information are not guarantees of future business activities and involve risks and uncertainties, and that the Company's future business activities may differ materially from those described in the forward-looking information as a result of various factors, including but not limited to fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing, and general economic, market, and business conditions. There can be no assurances that such forward-looking information will prove accurate, and therefore, readers are advised to rely on their own evaluation of the risks and uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the Canadian Securities Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278796