In a bold move aimed at accelerating its next-generation vertical-takeoff-and-landing (VTOL) ambitions, Archer Aviation (ACHR) has recently inked a new strategic collaboration with Karem Aircraft (KRMN), an aerospace firm renowned for military-grade technology.

The partnership aims to integrate Karem’s advanced rotor and tiltrotor innovation into Archer’s next-generation autonomous, hybrid-propulsion VTOL aircraft. The deal strengthens Archer’s push to develop a dual-use vertical-lift platform aimed at both commercial and military markets, offering modern autonomy, long-range hybrid capability, and cutting-edge aeromechanics.

Founder and CEO Adam Goldstein said that leveraging Karem’s Army-validated rotor systems will accelerate development and outperform legacy aircraft. The announcement follows Archer’s recent agreement to supply its electric powertrain to Anduril and EDGE Group for their Omen Autonomous Air Vehicle. ACHR shares rose on the news.

Given this backdrop, along with Archer’s growing global partnerships, a large order book, and expanding infrastructural investments, is now the time to take a position in ACHR stock?

About Archer Aviation Stock

Headquartered in San Jose, California, aerospace company Archer Aviation was founded in 2018, to design and develop electric vertical takeoff and landing (eVTOL) aircraft, targeting both urban air mobility (UAM) and defense-sector markets. The firm’s market cap is roughly $5.4 billion.

Its stock price performance so far in 2025 has painted a volatile picture, one that underscores both the promise and uncertainty surrounding the eVTOL-aircraft developer. The stock had reached a 52-week high of $14.62 on Oct. 15, which has since corrected to around $9.06, reflecting a sharp 61.4% pullback from its peak.

Year-to-date (YTD), it has declined 7.54%, erasing much of 2024’s strong gains. For context, Archer had seen a dramatic uplift in 2024, as enthusiasm around its potential in launching a commercial eVTOL aircraft and potential regulatory approvals drove investor optimism. Nevertheless, the stock is still up by 29.53% over the past 52 weeks.

So, what’s behind the sell-off and weak performance this year? Despite approving plans and ambitious timelines, the company remains pre-revenue and continues burning cash, which spurred investor concern about how soon it will ever generate actual sales. Also, heavy dilution fears spooked the market, leading many early-2025 investors to take profits.

However, Archer hasn’t lacked for ambition or headlines. Strategic moves like acquisitions and partnerships have helped sustain interest in the stock. For instance, the recent news of the collaboration with Karem Aircraft has propelled the stock higher by 2.6% on Dec. 2 and a solid 9.2% on the following day.

The stock is trading at a discount to its industry peers in terms of price/book of 2.94.

Bottom Line in the Red

Archer Aviation’s third-quarter 2025 results were released on Nov. 6. In Q3 2025, Archer reported a net loss of $129.9 million, worse than the $115.3 million loss it posted in Q3 2024. Its loss per share came in at $0.20, compared to $0.29 in the prior-year quarter.

Total operating expenses rose significantly over the past year, from around $122.1 million in Q3 2024 to about $174.8 million in Q3 2025, a reflection of heavier investment in R&D, certification efforts, and broader build-out as the firm ramps toward production.

The adjusted EBITDA loss widened from approximately $93.5 million in Q3 2024 to $116.1 million in Q3 2025, underscoring that core operations continue to burn cash as the company invests in development and scaling.

On the liquidity front, Archer ended the quarter with roughly $1.64 billion in cash, equivalents, and short-term investments, giving it a substantial cash runway despite ongoing losses. This compares with about $501.7 million in cash at the end of Q3 2024.

The marked increase reflects sizable equity raises and is meant to fuel continued investment in certification, manufacturing capacity, and infrastructure.

Archer provided guidance for Q4 2025, projecting adjusted EBITDA losses in the range of $110 million to $140 million.

Analysts predict loss per share to be around $1.03 for fiscal 2025, improving 27.5% year-over-year (YOY), before improving by another 7.8% annually to $0.95 in fiscal 2026.

What Do Analysts Expect for Archer Aviation Stock?

Earlier this month, Goldman Sachs (GS) initiated coverage of Archer Aviation with a “Neutral” rating and a $11 price target. Goldman believes Archer’s Midnight aircraft could be one of the most capable in the eVTOL category. The investment bank also sees potential in Archer’s early-stage defense opportunities through its Anduril partnership, though it cautions that no formal DoD programs exist yet.

On the other hand, Cantor Fitzgerald reiterated its “Overweight” rating and $13 price target on Archer Aviation last month, highlighting continued momentum in its Launch Edition Program and progress toward deploying the Midnight aircraft in early-adopter markets such as Abu Dhabi. Archer delivered its first aircraft to the United Arab Emirates and has begun receiving milestone-based payments.

The company is targeting initial revenue in 2026 and remains on track for UAE certification as early as the third quarter of that year, while U.S. development continues through piloted flight testing ahead of Type Inspection Authorization. Cantor still expects full FAA Type Certification no earlier than late 2026.

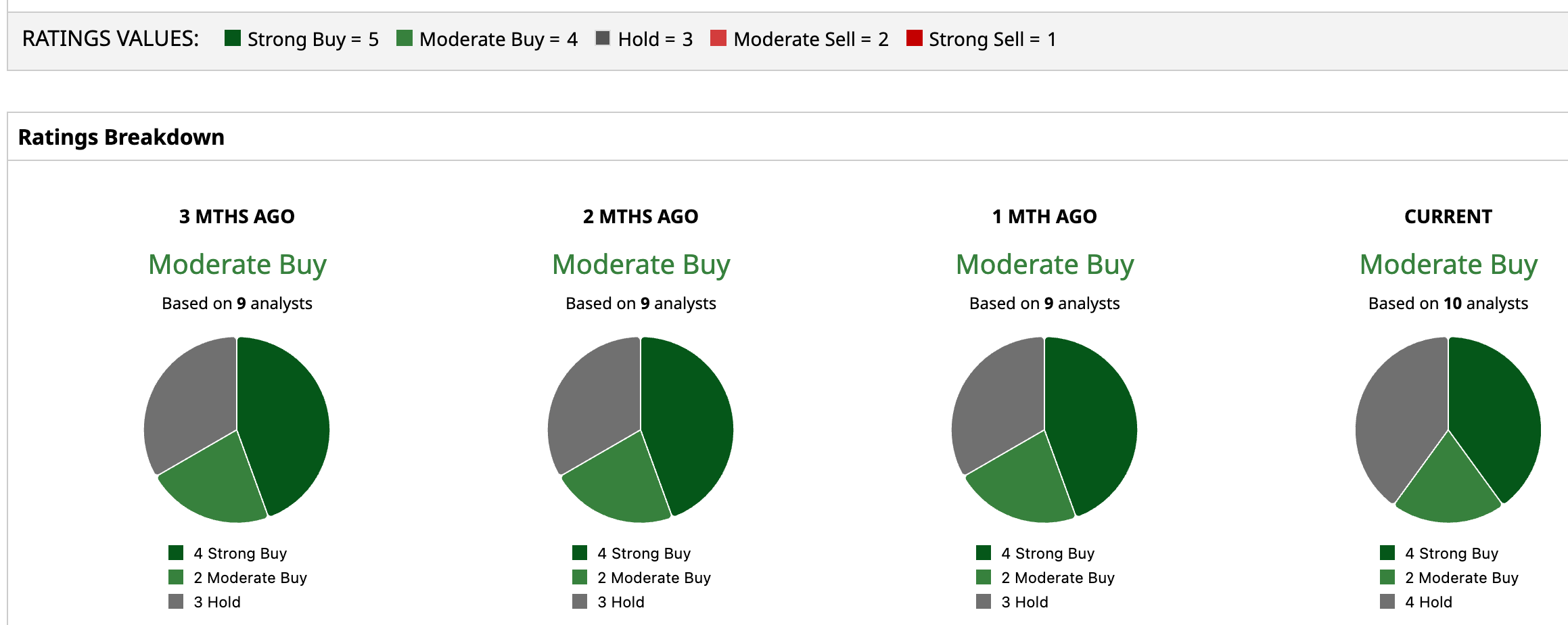

Overall, ACHR has a consensus “Moderate Buy” rating. Of the 10 analysts covering the stock, four advise a “Strong Buy,” two suggest a “Moderate Buy,” and the remaining four analysts are on the sidelines, giving it a “Hold” rating.

The average analyst price target for ACHR is $11.61, indicating a potential upside of 29.7%. The Street-high target price of $18 suggests that the stock could rally as much as 101%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Archer Aviation Just Signed on a New Aerospace Partner. Should You Buy ACHR Stock Here?

- Stifel Says This 1 ‘Picks and Shovels’ AI Stock Is a Buy for Massive Growth in 2026

- As Trump Looks to Boost Robotics, This 1 Lesser-Known Stock Is a Strong Buy

- With Fears Swirling, IBM Says There Is No AI Bubble. Does That Make IBM Stock a Buy Here?